- #TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND FOR FREE#

- #TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND FULL#

- #TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND SOFTWARE#

- #TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND FREE#

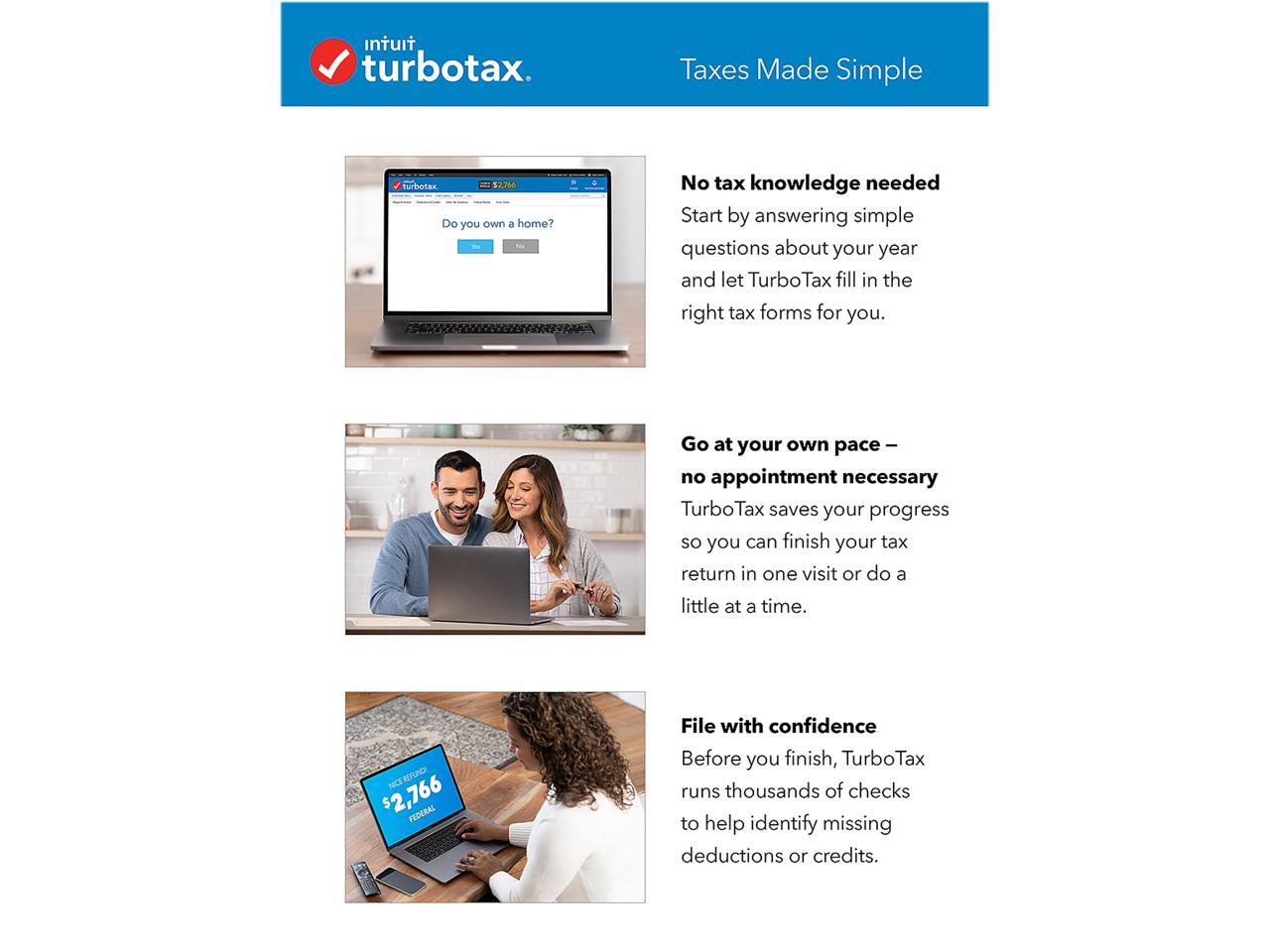

If the free version doesn't meet your needs, the next options cost $24.95, $34.95, and $64.95, not considering any discounts. The lowest price points are the DIY packages. The website offers a simplified quiz you can take (pictured below) that helps you determine which package may be best for you.

#TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND FOR FREE#

Access to experts, called Xpert Assist, is available for free at all price points.Įach option has different price points depending on how complicated your tax situation is.

#TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND FULL#

TaxAct offers three main ways to prepare and file your taxes: file on your own, opt for a professional to file for you (Xpert Full Service), or a downloadable computer software. In other words, the more streams of income you have and/or the more deductions or credits you qualify for, the more expensive it will be to prepare your return. Prices vary based on how complicated your tax situation is and what types of income streams and deductions you'll need to include. You can pay as little as $0 or as much as $189.95 to file your own taxes with TaxAct. You can check the company's website to see current offers. The prices listed in this article do not include any discounts. Tax prep companies frequently offer discounts on products early in the season. For forms and publications, visit the Forms and Publications search tool.How much does it cost to file your taxes with TaxAct? We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application. We translate some pages on the FTB website into Spanish.

If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide. Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Include an updated California Beneficiary’s Share of Income, Deductions, Credits, etc.Include the estate or trust name and FEIN with each item.On a separate paper, explain all changes.Sacramento, CA 94257-0500 Estates and trustsįile a California Fiduciary Income Tax Return (Form 541) for estates and trusts:

#TURBOTAX 2015 HOME AND BUSINESS START NEW RETURN TO AMEND SOFTWARE#

Submit online or by mail: Online Through your tax representative or tax preparation software Mail Franchise Tax Board Limited Liability Company Return of Income (Form 568)Ģ.

Fill out the correct form for your business. If you’re not changing your tax liability (income, credits, deductions, etc.), contact us. Submit your amended return online or by mail: Online Through your tax representative or tax preparation software Mail Franchise Tax Boardįollow these steps to amend your tax return. 540X for that tax year (find in our form locator) and related supporting documents.Corrected California Resident Income Tax Return Form 540 ( 540 2EZ, California Nonresident or Part-year Resident Income Tax Return 540NR) and related supporting documents.California Explanation of Amended Return Changes (Schedule X).Gather and fill out the following: Tax year 2017 to present You amended your federal tax return or recently audited by the IRS Change from standard to itemized deductions.Add a subsidiary to a combined tax return (corporations).Add or remove income from a W-2, 1099, K-1, etc.Limited Liability Company Return of Income (Form 568)Ĭommon reasons why you need to amend a return Reason.Partnership Return of Income (Form 565).Amended Corporation Franchise or Income Tax Return (Form 100X).

0 kommentar(er)

0 kommentar(er)